LIFE INSURANCE

As we grow old, our insurance needs, requirements and expectations change. Our Life insurance Edmonton solutions could be very helpful for you in your quest to ensure the financial stability of your family in case of unforeseeable circumstances.

With over 12 years of experience in the industry, we know exactly what it means to you when you invest in a life insurance and have made sure on countless occasions that we can deliver the best.

This is no hidden fact that there happen to be a bunch of insurance solutions and providers in Canada. What you really need to focus on is your requirements and options so that you can make the right choices and get the best insurance plan for your money.

Benefits of a personal Life Insurance

The other alternative being the insurance coverage you would get from the place of work where you are employed and in obedience with the terms that your employers have adopted.

If and when you decide to walk out of your current occupation, your insurance and summed up equivalents mean nothing altogether and just vanish away. This is not the case with a personal insurance Edmonton service offered by Onkar consultants.

Edmonton Life Insurance Terms

In general, the following are some of the key factors that all life insurance providers keep in mind when giving or approving your requests:

- Age

- Sexual Orientation

- Well Being

- Medical history

- Lifestyle

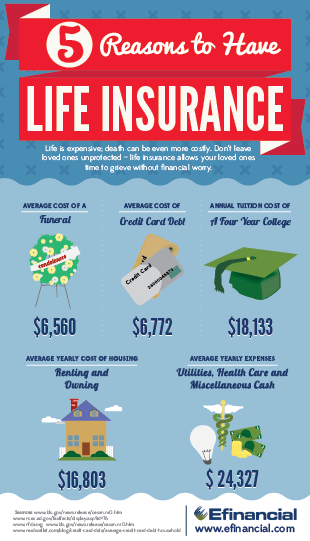

Source: Efinancial.com

Our insurance expert Mr. Amandeep Bath can help provide you the best insurance cover and plan to make sure you get the best benefits while choosing.

Personal Insurance Edmonton

A personal life insurance is the one where your individual income, expenses, mortgages, statements, and assets are taken into account to deliver to you the best insurance plans.

There terms remain valid forever in almost all cases. So, a personal insurance definitely gives you an edge over the other insurances tied up with companies.

TYPES OF LIFE INSURANCE

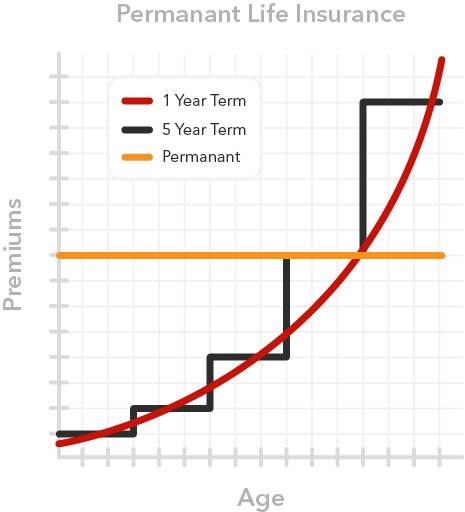

Broadly, there are three types of Life Insurances. They can be differentiated on the basis of the premiums that are associated with each one of them.

- TERM LIFE INSURANCE

- WHOLE LIFE INSURANCE

- UNIVERSAL LIFE INSURANCE

A Term life insurance is the one in which the subject applying for the service needs to pay up premiums to keep the cover alive and running. There are mainly two types of terms namely the One Year Term and the Five year term.

A One year term Insurance is the one when there is marginal increment in the premiums paid by the subject in question.

A five year Term insurance would mean that the subject is supposed to pay ta certain amount of premium which is for a period of 5 years. After the five years get over, there is an increment in the premium amount for the next years.

Similarly, there can be a 10 year term insurance agreement as well.

Source:lifeinsurancecanada.com

Whole Life Insurance Edmonton

A whole life insurance is the one in which the subject in question is supposed to pay the same premium every year for the entirety of their life.

It is usually a very common phenomenon to notice that the premium rates are significantly higher for this type of insurance in the first few years but when we take a look at the bigger picture, the rates are conveniently less than the market rates towards the second half of the insurance term.

Universal Life Insurance Edmonton

A Universal Life insurance is one in which we have an option to become an investor with the firm and submit more dividends apart from the fixed premium payments.

This additional money is expected to mature with the insurance company itself and reaps out the rate that is fetched in the market as and when the policy expires.

Disability Insurance

Read More about Disability Insurance here. Apply for an insurance in Edmonton here.

Critical Insurance

Read More about Critical Insurance here.

Drug and Dental Insurance

Read more about Drug Insurance here.

Visitor's Insurance

Read More here

Travel Insurance

Read more here.